In her latest Facebook posting, Sarah Palin asks the questions that should have been asked at Hussein’s press conference? She totally bitch slaps our weak and incompetent leader.

Nearly 40 days in, our President finally addressed the American people’s growing concerns about the Gulf Coast oil spill. Listening to today’s press conference, you’d think the administration has been working with single-minded focus on the Gulf gusher since the start of the disaster. In reality, their focus has been anything but singular to help solve this monumental problem.

If the President really was fully focused on this issue from day one, why did it take nine whole days before the administration asked the Department of Defense for help in deploying equipment needed for the extreme depth spill site?

Why was the expert group assembled by Energy Commissioner Steven Chu only set up three weeks after the start of this disaster?

Why was Governor Jindal forced more than a month after the start of the disaster to go on national television to beg for materials needed to tackle the oil spill and for federal approval to build offshore sand barriers that are imperative to protect his state’s coastline?

Why was no mention of the spill made by our President for days on end while Americans waited to hear if he grasped the import of his leadership on this energy issue?

Why have several countries and competent organizations who offered help or expertise in dealing with the spill not even received a response back from the Unified Area Command to this day?

The President claimed that “this notion that somehow the federal government is somehow sitting on the sidelines and for the last three or four or five weeks we’ve just been letting BP make a whole bunch of decisions is simply not true.” But, in fact, that is how U.S. Coast Guard Commandant Thad Allen described the Obama administration’s approach to this crisis: “We keep a close watch.”

Listening to the President, you get the impression he is continually surprised by the inability of various centralized government agencies to get more involved and help solve problems. His lack of executive experience might explain this because he is apparently unaware that it’s his job as a chief executive to make sure they do their jobs and help solve problems.

The fundamental problem at the core of this crisis is a lack of responsibility. (I risk the President taking my comments personally, but they’re not intended to be personal; my comments reflect what many others feel, and we just want to help him tackle this enormous spill problem.) There’s a culture of buck-passing at the heart of this administration that has caused the tragedy of a sunken oil rig to turn into a potential disaster.

The 1990 Oil Pollution Act was drafted in response to the Exxon-Valdez spill in my home state. It created new procedures for offshore cleanups, specifically putting the federal government in charge of such operations. The President should have used the authority granted by the OPA – immediately – to take control of the situation. That is a big part of what the OPA is for – to designate who is in charge so finger-pointing won’t disrupt efforts to just “plug the d#*! hole.” But instead of immediately engaging with this crisis, our President chose to spend precious time on political pet causes like haranguing the state of Arizona for doing what he himself was supposed to do – secure the nation’s border. He also spent much time fundraising and politicking for liberal candidates and causes while we waited for him to grasp the enormity of the Gulf spill.

Now that the American people are calling him out on his lack of engagement with this disaster, the buck-passing is in full swing – and, unbelievably, his administration is still looking to blame his predecessor. Amazingly, even those of us who support energy independence for America are the brunt of some buck-passing.

He suggested today that a “culture of corruption” at the U.S. Minerals Management Service (MMS) was solely the previous administration’s responsibility and that the failure of the inspection system was a failure of that administration. That is false. The MMS has been his responsibility since January 20, 2009.

The MMS director who resigned today, Elizabeth Birnbaum, was appointed by his administration. And the most recent inspection of the oil rig took place a mere 10 days before the explosion – also very much on his watch, not President Bush’s.

The President is also now attempting to somehow distance himself from his administration’s recent decision to open a few areas of the continental shelf to oil and gas exploration. That’s unfortunate because America desperately needs our domestic oil and natural gas. We rely on it for our prosperity, security, and freedom. The President’s decision to open a few areas to offshore exploration was the right decision then; and unlike his quickly evolving position on energy development now, I continue to believe it’s the right decision today – because energy independence is in the long-term economic and security interests of the United States.

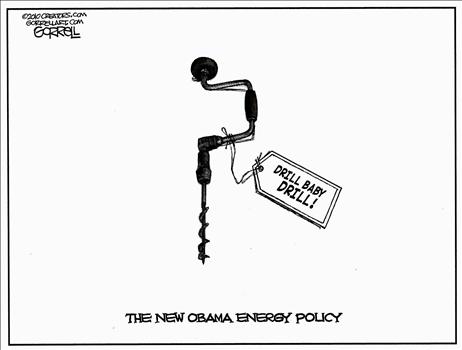

As I explained in an article in National Review last year, conventional sources like natural gas “can act as a clean ‘bridge fuel’ to a future when more renewable sources are available.” I do not, as the President mistakenly believes, think we can “drill, baby, drill” our way out of all of our troubles. As I have consistently stated, we need an “all of the above” approach to energy independence that combines conventional drilling with energy conservation and renewable-energy development. My record in Alaska clearly shows my commitment to this “all of the above” approach. Over 20 percent of Alaska’s electricity currently comes from renewable sources. As governor, I put forward a long-term plan to increase that figure to 50 percent by 2025, which is the most ambitious renewable energy target in the nation. I take great pride in helping to make Alaska, in the words of the New York Times, “a Frontier for Green Power,” even as we continue to embrace the need to “drill, baby, drill” at the same time.

Alaska can be that frontier for renewable energy only because our conventional oil and gas reserves provide us with “a bridge” to a greener energy future. In fact, Alaska has enough reserves of both oil and gas to help the United States cross that bridge – if only we are allowed to drill!

Please, Mr. President, hear me on this, if nothing else: if it’s your administration’s decision to suspend the leases of new oil field developments off the coast of Alaska in response to the Gulf’s deepwater spill, and you still remain committed to locking up ANWR and other oil-rich lands, please know you are making a mistake. Unless we continue to drill here and drill now, we risk digging ourselves deeper into the hole created by our continued dependence on foreign energy – which often comes from regimes that care nothing for our prosperity or security, and even less for global environmental safety.

We need affordable, reliable, secure, environmentally-sound, and domestically-produced energy, but this administration continues to lock up federal land filled with huge energy reserves. If there is to be a moratorium on offshore development, then it’s time we stop ignoring our safest options for domestic development – places like ANWR and NPR-A in my home state of Alaska.

And it’s time for the administration to stop passing the buck and get control of the disaster in the Gulf. There’s a reason why Harry Truman had that famous sign on his desk. The “buck stops” with the occupant of the Oval Office. When the American people elected President Obama they gave him responsibility to handle this disaster. He promised to “heal the earth, and watch the waters recede…” or something far-fetched like that. It was unbelievable then, it’s impossible now, but what I believe he meant was that he promised to be held accountable. With all due respect, Mr. President, you have a huge job in front of you. We hope you’re learning. Please learn that we must have domestic energy development, you must stop looking backward and blaming Bush, and we must all work together to “plug the d#*! hole.”

– Sarah Palin