Employer health insurance must cover employees dependent children up to age 26, but there is nothing that says it has to cover spouses. The fees associated with the plan are causing employers to reconsider whether or not to included wives and/or husbands in their medical plans.

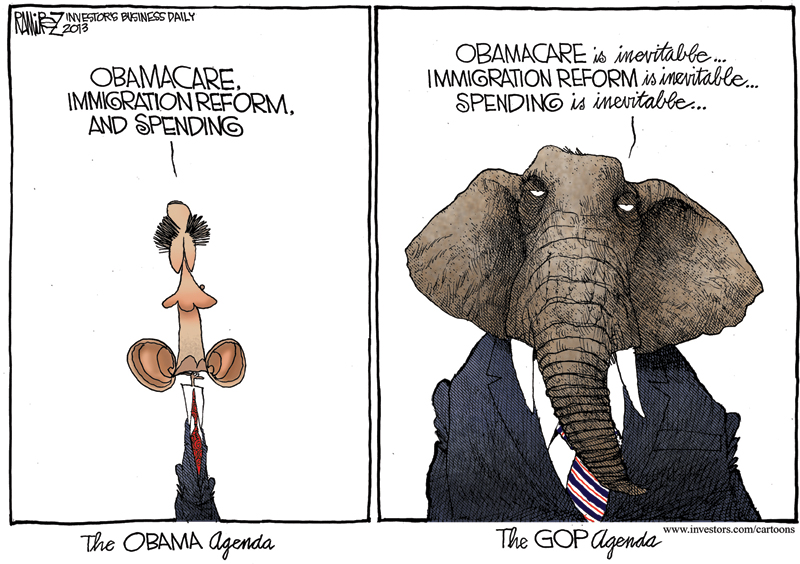

When it comes down to it, ObamaCare could actually be considered a War On The Family Unit.

Dumped: An unintended consequence of the abomination that is called ObamaCare is the dropping of wives from husbands’ employer-provided health care insurance. It’s a de facto war on women.

ObamaCare is filled with grinding mandates. One of them requires that children remain covered by their parents’ health care plans until they’re 26 when their parents’ insurance “provides dependent coverage of children.”

The government calls this “protecting young adults.” But insuring children long past the day they are dependent on their parents exposes companies, which will bear the added costs of paying the inevitable higher premiums. And in some cases, the extra expense could be significant.

So at many companies, something has to go. Quite often, the rational response to rising health insurance costs is to drop spouses, more specifically wives, from insurance plans. Sometimes it’s the husbands who must go. But benefits experts have confirmed to MarketWatch that those who are kicked out of plans “tend to be women.”

Employers also have a strong incentive to drop spouses because of a “per life” fee that ObamaCare requires from companies that insure their workers. That fee is now $1 or $2 per life. But it will be substantially more — $65 — in 2014.

The trend of dumping spouses will only accelerate when the federal health exchanges are open next year, health care experts told MarketWatch.

Employers are reluctant to leave spouses without coverage, and the exchanges will give the suddenly uninsured a place to land.

But it’s unlikely the place they’ll want to be after having become accustomed to the superior coverage from their spouses’ plans.

Again, so much for President Obama’s promise that under the Democrats’ overhaul, “If you like your health care plan, you can keep your health care plan.”

The Democrats’ “reform” has a malign knack for decoupling people from the health care arrangements they’ve worked so hard for so many years to achieve, and spouses aren’t the only ones affected.

Many employees will lose their coverage when employers figure out that it’s more cost-effective for them to stop insuring their workers and just let them fall into the exchanges.

How many? More than a few. The business journal McKinsey Quarterly surveyed 1,300 employers and found that “Overall, 30% of employers will definitely or probably stop offering ESI (Employer Sponsored Insurance) in the years after 2014.”

But it’s likely that a larger portion will actually make that choice as companies learn more about ObamaCare.

“Among employers with a high awareness of reform, this proportion increases to more than 50%, and upward of 60% will pursue some alternative to traditional ESI,” the McKinsey Quarterly says.

Not all spouses will be jettisoned from employer coverage due to the dependent coverage mandate. Some companies will simply require their employees to pay a spousal surcharge rather than drop them from the insurance rolls. Expect those surcharges to be $500 to $1,000 a year, says Forbes.

Sure, the spouses will be able to keep their plans. But the higher-cost insurance will be a much worse deal than in the days before ObamaCare.

It’s unlikely that the Democrats intended to wage a war on women when they decided to include the dependent care mandate in ObamaCare. Yet that’s the unintended consequence of their actions.

And no one should be surprised.

The nearly 1,000 pages of the bill that became the Patient Protection and Affordable Care Act were rammed through Congress before they could be read. It was bound to have traps and gaps, to confuse and confound.

But that’s what happens when law is made in haste so that the public won’t know until much later just how harmful it is.

Source…