Tag: Fannie Mae

Freddie Mac CFO Found Dead

The plot thickens….

No doubt the “Main Stream Media” will attempt to keep this quiet or brush over it. Nothing to see here, move along!

David Kellermann, Acting Chief Financial Officer and Senior Vice President of Freddie Mac, was found dead this morning.

Fairfax County Police officials tell 9NEWS NOW they responded to his home around 5 a.m. after his wife alerted them to his suicide.

Kellermann was 41 years old.

According to Freddie Mac’s website, Kellerman was with Freddie Mac for more than 16 years and named Acting Chief Financial Officer in September.

WUSA-TV and WTOP Radio reported that David Kellermann was found dead in his Northern Virginia home. The 41-year-old Kellermann has been Freddie Mac’s chief financial officer since September.

Sabrina Ruck, a Fairfax County police spokesman, confirmed to The Associated Press that Kellermann was dead, but she could not confirm that he committed suicide.

Kellermann’s death is the latest blow to Freddie Mac, a government controlled company that owns or guarantees about 13 million home loans. CEO David Moffett resigned last month.

McLean, Va.-based Freddie Mac and sibling company Fannie Mae, which together own or back more than half of the home mortgages in the country, have been hobbled by skyrocketing loan defaults and have received about $60 billion in combined federal aid.

Kellermann was named acting chief financial officer in September 2008, after the resignation of Anthony “Buddy” Piszel, who stepped down after the September 2008 government takeover.

The chief financial officer is responsible for the company’s financial controls, financial reporting and oversight of the company’s budget and financial planning.

Before taking that job, Kellerman served as senior vice president, corporate controller and principal accounting officer. He was with Freddie Mac for more than 16 years.

Chris Dodd and His Cosy Irish Cottage

Drudge should make a screaming headline out of this today since Dodd is up on deck grilling Ben Bernanke and Tim Geithner today at the Senate Banking Committee.

An intriguing item here from the dogged Kevin Rennie of the Hartford Courant that highlights a classic example of why ordinary citizens become cynical about politicians and the way business in Washington is conducted.

Silver-haired Senator Christopher Dodd, chairman of the Senate Banking Committee, has already been getting a lot of heat for his two 2003 VIP mortgage loans from Countrywide, one of the major actors in triggering the current financial crisis.

Seeking Senate re-election in 2010, the 2008 presidential candidate (he dropped out on the first day of voting after finishing seventh in Iowa, where he had moved with his family as a way of courting voters) is now in a bit of a sticky spot with another accommodation- his “cottage” on the lovely Irish island of Inishnee.

Some digging from Rennie (a lawyer and former Connecticut state legislator) reveals that as well as there being a cloud over Dodd’s properties in Connecticut and Washington DC, considerable murkiness surrounds the financial arrangements for the purchase of his “cottage”.

As Rennie outlines, Dodd became part owner of the 10-acre Galway property in 1994 along with Missouri businessman William Kessinger, whom Dodd knew through investor Edward R. Downe Jnr, who had pleaded guilty the previous year to insider trading charges. The mortgage was listed as “between $100,001 and $250,000”. Downe was a witness to Kessinger’s purchase.

In 2001, Dodd circumvented the US Justice Department to help get his pal Downe a full pardon on President Bill Clinton’s last day in office. The following year, Dodd bought off Kessinger’s two-thirds share of the “cottage” for, Dodd said, $127,000.

Ever since then, Dodd has continued to list the value of the property as “between $100,001 and $250,000”.

Check out the picture of Dodd’s “cottage” (provided to me by Rennie), where he spends summers and which is looked after during the rest of the year by a caretaker. It’s not exactly the humble tumbledown abode with a leaky thatched roof, a fireplace with peat thrown on it and donkey tethered outside that the Senator might like you to envisage.

The nearby village of Roundstone is a celebrity hangout. When he’s there, the Sunday Times reported in 2007, he’s likely to “rub shoulders with [RTE’s] Pat Kenny, Bill Whelan of Riverdance, Lochlann Quinn, the former AIB chairman, and the singer Brian Kennedy”.

Given the Irish property boom, a conservative estimate would be that the house would be worth approaching $1 million, and very possibly much more than that.

So why hasn’t Dodd declared a more realistic true value of the property? No doubt he didn’t want to highlight the fact that he had a third splendid pile, to go along with his residences in DC and Connecticut, as he sought the presidency (remember how all those homes harmed John McCain?). Maybe he knew it would mean further scrutiny of his connection with the pardoned crook Downe.

Now that President Barack Obama – whom Dodd enthusiastically endorsed for president over Hillary Clinton – has declared a new era of ethical government in Washington, his former Senate colleague will order a fresh, long overdue reappraisal of its value. Or perhaps the Senate Ethics Committee will look into the matter.

Call me cynical, but I wouldn’t advise you to hold your breath.

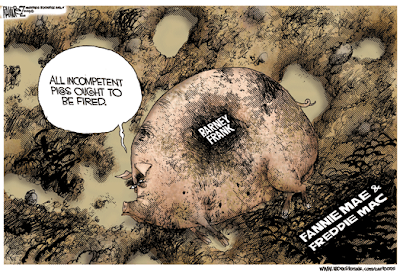

Follow the Money: How Fannie Mae Bought the Democrat Party

The collapse of government backed mortgage giants Fannie Mae and Freddie Mac caused the financial crisis now gripping the American economy.

Who is to Blame?

How did it happen?

Follow the money.Senator Chris Dodd (D-CT), Chairman of the Senate Committee overseeing Fannie and Freddie received $165,400 in contributions from individuals and PACS for both mortgage giants since 1989.

That’s over $8,000 per year.

But Obama’s cash card is much better:

Since taking office in January 2005 he has amassed over $126,000. Thats roughly $32,000 PER YEAR!Also along for the ride:

Kerry, John $111,000

Reid, Harry $77,000

Clinton, Hillary $76,050

Pelosi, Nancy $56,250

Frank, Barney $42,350

Durbin, Dick $23,750

Schumer, Charles D $24,250Is it any wonder that the 2005 reforms Senator McCain championed never passed?

If Congress does not act, American taxpayers will continue to be exposed to the enormous risk that Fannie Mae and Freddie Mac pose to the housing market, the overall financial system, and the economy as a whole. ~ John McCain, May 26, 2005