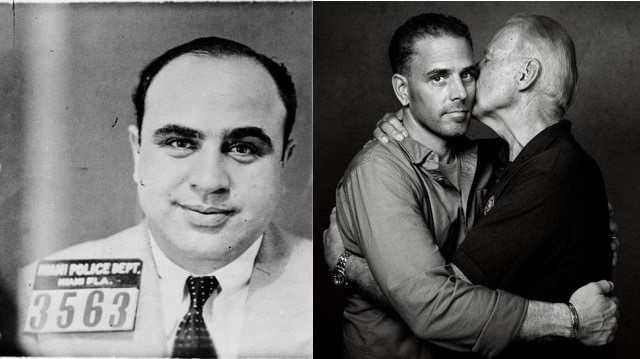

Tax evasion is a serious offense that can lead to severe legal consequences. Over the years, there have been numerous high-profile cases involving individuals accused of evading taxes, resulting in public scrutiny and legal proceedings. One such infamous case is that of Al Capone, the notorious gangster of the 1920s, and the more recent case of Hunter Biden, son of Joe Biden. In this article, we will explore the differences between the indictments faced by Al Capone and Hunter Biden for tax evasion, and the reasons why Capone was ultimately sentenced while Hunter Biden was not.

I. Background on Al Capone’s Tax Evasion Case

Al Capone, a prominent figure in organized crime during the Prohibition era, was indicted on charges of tax evasion in 1931. The Internal Revenue Service (IRS) pursued Capone for his alleged failure to report income earned through illegal activities such as bootlegging and gambling. Despite the extensive criminal empire he controlled, Capone was ultimately convicted and sentenced to 11 years in prison.

Evidence and Investigation

The prosecution built its case against Capone by meticulously gathering evidence of his income and expenditures. They interviewed witnesses, examined financial records, and scrutinized his lifestyle, which included luxurious mansions, cars, and extravagant expenditures. Additionally, the government seized his ledgers and account books, which provided substantial evidence of unreported income. These comprehensive investigations formed the foundation for Capone’s indictment and subsequent conviction.

The Legal Strategy and Trial

The prosecution faced challenges during Capone’s trial as they sought to prove that he had intentionally evaded taxes. The defense attempted to distance Capone from his illegal activities, arguing that he was merely an entrepreneur running legitimate businesses. However, the prosecution successfully demonstrated that Capone’s sources of income were primarily illicit.

Ultimately, Capone’s conviction hinged on the testimony of key witnesses and the compelling evidence of his financial records. In October 1931, he was found guilty of tax evasion and was sentenced to prison.

II. The Hunter Biden Tax Evasion Allegations

In 2019, the New York Post published a series of articles based on emails and other documents that were found on a laptop that Hunter Biden had abandoned at a repair shop in Delaware. The emails suggested that Hunter Biden had engaged in corrupt business dealings in Ukraine and China while his father, Joe Biden, was vice president.

In 2020, the Justice Department opened an investigation into the allegations, but the investigation was ultimately closed without any charges being filed. However, the allegations continued to dog Hunter Biden throughout the 2020 presidential campaign.

In 2022, the Justice Department reopened the investigation into Hunter Biden’s taxes. In May 2023, Hunter Biden reached a plea deal with prosecutors in which he agreed to plead guilty to two misdemeanor counts of failing to pay taxes for two years. He also agreed to enter a pretrial diversion agreement on a felony charge of possession of a firearm while using illegal drugs.

The plea deal was seen by some as a sign that Hunter Biden had finally been held accountable for his alleged misdeeds. However, others argued that the deal was too lenient and that Hunter Biden had gotten away with a crime that would have landed a less-privileged person in jail.

In addition to the allegations of tax evasion, two IRS whistleblowers have alleged that the Justice Department and the Delaware U.S. Attorney’s office engaged in political interference in the Hunter Biden investigation. The whistleblowers allege that the investigation was slow-walked and that the Justice Department tipped off Hunter Biden’s attorneys about the investigation.

The Justice Department has denied the whistleblower allegations. However, the allegations have raised questions about the handling of the Hunter Biden investigation and the potential for political bias.

Only time will tell what the ultimate consequences of the Hunter Biden tax evasion allegations and the whistleblower allegations will be. However, the allegations have already had a significant impact on American politics and have raised important questions about the role of family members in government.

Final Thoughts

The comparison between the tax evasion cases of Al Capone and Hunter Biden raises intriguing questions about the justice system and the potential influence of power and privilege. While Al Capone, a notorious gangster, was ultimately held accountable for his crimes and sentenced to prison, Hunter Biden’s case has yet to result in formal charges. This stark contrast underscores the disparity in how justice is served in different circumstances.

The implications of these divergent outcomes are unsettling. It highlights a perception of a two-tiered justice system, where the wealthy and well-connected seemingly evade severe consequences for their actions. Skepticism and cynicism towards the fairness of the legal system are bound to arise when high-profile cases like Hunter Biden’s fail to lead to indictments or convictions.

While it is crucial to emphasize that the ongoing investigation into Hunter Biden’s financial affairs may reveal additional information, the current lack of charges fuels public skepticism. It raises concerns about the potential for powerful individuals to manipulate the system and escape accountability for their alleged wrongdoing.

In order to maintain public trust in the justice system, it is imperative that investigations and legal proceedings are conducted without bias or undue influence. Transparency, fairness, and consistency are vital to ensure that the consequences for tax evasion or any other crimes are applied equally to all individuals, regardless of their status or connections.

Ultimately, the differing outcomes between Al Capone and Hunter Biden’s cases serve as a somber reminder that justice can sometimes appear elusive, particularly when confronted with wealth, power, and influence. It is a call to reflect upon the shortcomings of the system and strive for a more equitable and impartial administration of justice, where everyone is held accountable for their actions, regardless of their standing in society.