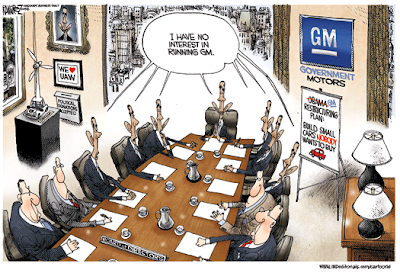

“The people saying they don’t want to buy anything at General Motors are not mad at General Motors. They don’t want to patronize Obama. They don’t want to do anything to make Obama’s policies work! This is an untold story, by the way. Of course, the government-controlled media is not gonna report anything like this but there are a lot of people who are not going to buy from Chrysler or General Motors as long as it is perceived Barack Obama is running it, because people do not want his policy to work here because this is antithetical to the American economic way of life. The government does not own car companies; the government does not design cars, not in a country that works. So people aren’t going to buy products from companies that Obama runs.” ~ Rush Limbaugh

Amid bankruptcies and forecasts of Detroit doom, one of the Big Three is hanging tough. Ford tough.

Once defined by the revolutionary Model T, Ford is motoring on without federal bailouts, Treasury-led restructurings or bankruptcy judges.

Ford Motor Co.’s U.S. market share grew last month, and sales surpassed even mighty Toyota’s. Ford’s shares have outperformed those of Honda and Toyota over the past year. Shares of archrival General Motors Corp., now in bankruptcy, are nearly worthless.

Shareholders and analysts see pluses and minuses in Ford’s decision to steer clear of government interference.

“Ford [may] be able to prevail taking the high ground and not taking government money,” said John Chevedden of Redondo Beach, Calif., who owns 600 shares of Ford stock. Mr. Chevedden said he purchased the stock “at a dip,” so he hasn’t lost any money on his investment.

He called himself “cautiously hopeful” based on production increases and Ford’s upbeat annual report released last month. He thinks Ford will benefit from the downsizing of GM and Chrysler LLC – as its production increases are designed to do.

Mr. Chevedden said he was more concerned with the overall economy than with Ford.

“The concern is just about the market in general, whether it’s going to rebound or if people will just buy less cars,” he said.

Tom Whited, a financial adviser for Edward Jones Investments in Plymouth, Mich., said such uncertainties keep him from recommending Ford stock even though the shares have performed better than expected.

“There are so many question marks around the Detroit auto industry in general that I think there are better options,” he said.

Mr. Whited also worries that Ford will have difficulty competing with Chrysler and GM after they come out of their bankruptcies “debt free.”

The company’s decision to go it alone prompted shareholder Jason Kozlowski of Toledo, Ohio, to buy Ford stock three months ago.

“I’m thinking because they didn’t take the bailout money, because they decided to do their own thing, that they will eventually pull out of it,” he said. “It looks like they’re going to hold their own.”

Auto analyst Colin Langan of UBS, which does investment banking for Ford, agreed.

Mr. Langan said Ford will benefit in the long run by avoiding the involvement of the government and the United Auto Workers union in its restructuring, giving it more flexibility and the ability to focus on profits.

“I think [GM’s bankruptcy] is an opportunity for Ford to stand out from U.S. competitors,” Mr. Langan said.

Ford’s increasing global presence, as well as the scheduled U.S. arrival of new models like the Fiesta next year, bode well for the company’s future.

“I really looked at [Ford’s] prior turnarounds and elements in past successful turnarounds, and every turnaround has had a new product,” Mr. Langan said.

“I think there are definite, clear opportunities for Ford to gain market share.”

Indeed, Ford’s U.S. market share in May reached its highest level since 2006, rising to 17.4 percent from 15.2 percent a year ago. But Ford spokesman Bill Collins said GM’s bankruptcy has not affected Ford’s plans.

“Things have not changed in the way we’re running the business,” Mr. Collins said.

Ford’s domestic sales totaled 155,994 vehicles last month as its Fusion hybrid and Flex crossover models set sales records. Ford even outsold Japanese rival Toyota, which notched 135,661 U.S. sales. Ford’s May results were the best since July, when it sold 161,530 vehicles.

With investors still wary of stocks and especially shares of automakers, Ford’s common stock has surged from a low of $1.26 last year to close at a 52-week high of $6.41 on Tuesday. Ford shares, while virtually unchanged over the past year, have handily outperformed those of Japanese rivals Toyota and Honda, whose shares have fallen 24 percent and 18 percent, respectively.