Follow the Money: How Fannie Mae Bought the Democrat Party

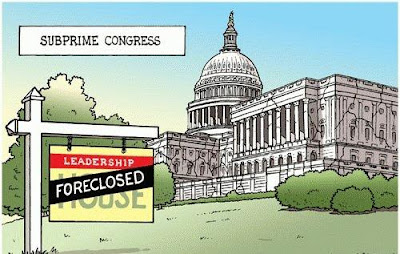

The collapse of government backed mortgage giants Fannie Mae and Freddie Mac caused the financial crisis now gripping the American economy.

Who is to Blame?

How did it happen?

Follow the money.Senator Chris Dodd (D-CT), Chairman of the Senate Committee overseeing Fannie and Freddie received $165,400 in contributions from individuals and PACS for both mortgage giants since 1989.

That’s over $8,000 per year.

But Obama’s cash card is much better:

Since taking office in January 2005 he has amassed over $126,000. Thats roughly $32,000 PER YEAR!Also along for the ride:

Kerry, John $111,000

Reid, Harry $77,000

Clinton, Hillary $76,050

Pelosi, Nancy $56,250

Frank, Barney $42,350

Durbin, Dick $23,750

Schumer, Charles D $24,250Is it any wonder that the 2005 reforms Senator McCain championed never passed?

If Congress does not act, American taxpayers will continue to be exposed to the enormous risk that Fannie Mae and Freddie Mac pose to the housing market, the overall financial system, and the economy as a whole. ~ John McCain, May 26, 2005

Market Meltdown Caused By Fear Of A Socialist America

Investors’ Real Fear: A Socialist Tsunami

The Crash: “Why has the market dropped so much?” everyone asks. What is it about the specter of our first socialist president and the end of capitalism as we know it that they don’t understand?

The freeze-up of the financial system — and government’s seeming inability to thaw it out — are a main concern, no doubt. But more people are also starting to look across the valley, as they say, at what’s in store once this crisis passes.

And right now it looks like the U.S., which built the mightiest, most prosperous economy the world has ever known, is about to turn its back on the free-enterprise system that made it all possible.

It isn’t only that the most anti-capitalist politician ever nominated by a major party is favored to take the White House. It’s that he’ll also have a filibuster-proof Congress led by politicians who are almost as liberal.

Throw in a media establishment dedicated to the implementation of a liberal agenda, and the smothering of dissent wherever it arises, and it’s no wonder panic has set in.

What is that agenda? It starts with a tax system right out of Marx: A massive redistribution of income — from each according to his ability, to each according to his need — all in the name of “neighborliness,” “patriotism,” “fairness” and “justice.”

It continues with a call for a new world order that turns its back on free trade, has no problem with government controlling the means of production, imposes global taxes to support continents where our interests are negligible, signs on to climate treaties that will sap billions more in U.S. productivity and wealth, and institutes an authoritarian health care system that will strip Americans’ freedoms and run up costs.

All the while, it ensures that nothing — absolutely nothing — will be done to secure a sufficient, terror-proof supply of our economic lifeblood — oil — a resource we’ll need much more of in the years ahead.

The businesses that create jobs and generate wealth are already discounting the future based on what they know about Obama’s plans to raise income, capital gains, dividend and payroll taxes, and his various other economy-crippling policies. Which helps explain why world stock markets have been so topsy-turvy.

But don’t take our word for it. One hundred economists, five Nobel winners among them, have signed a letter noting just that:

“The prospect of such tax-rate increases in 2010 is already a drag on the economy,” they wrote, noting that the potential of higher taxes in the next year or two is reducing hiring and investment.

It was “misguided tax hikes and protectionism, enacted when the U.S. economy was weak in the early 1930s,” the economists remind us, that “greatly increased the severity of the Great Depression.”

We can’t afford to repeat these grave errors.

Yet much of the electorate is determined to vote for the candidate most likely to make them. If he wins, what we consider to be a crisis in today’s economy will be a routine affair in tomorrow’s.

Previously:

Evaluation: Stocks Plunge in Preparation for the Age of Obama

Saturday Night Live Skit Blames Democrats for the Financial Crisis

Stocks Plunge in Preparation for the Age of Obama

Has anyone noticed that as Obama’s poll numbers go up the stock market goes down? Is the world preparing for a Socialist America?

Dow industrials plunge 500 amid global sell-off

Wall Street tumbled again Monday, joining a sell-off around the world as fears grew that the financial crisis will cascade through economies globally despite bailout efforts by the U.S. and other governments. The Dow Jones industrials skidded nearly 500 points and fell below 10,000 for the first time in four years, while the credit markets remained under strain.

The markets have come to the sobering realization that the Bush administration’s $700 billion rescue plan won’t work quickly to unfreeze the credit markets, and that many banks are still having difficulty gaining access to cash. That’s caused investors to exit stocks and move money into the relative safety of government debt.