And ten times the man Barney Frank is!

Tag: Barney Frank

Glenn Beck on the AIG Government Scam

Glenn Beck gets right to the point. He lays out perfectly something our corrupt politicians and the “Main Stream Media” are trying to hide. AIG is being used as a money laundering system. The government is using them to funnel money so you don’t really notice.

The financial collapse and the theft of America’s wealth was engineered by the Federal Reserve. Chief architect and tax-cheat Timothy Geithner is the proverbial fox in the hen house.

Let The Inquisition Start With Frank

Let The Inquisition Start With Frank

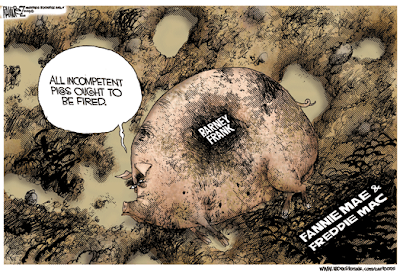

Oversight: Congressman Barney Frank says he wants some of those responsible for our current financial meltdown to be prosecuted. And we couldn’t agree more. First up in the court dock: Rep. Barney Frank, D-Mass.

Even by the extraordinarily loose standards of Congress, it takes some chutzpah for someone such as Frank to suggest that he’ll seek prosecutions for those behind the housing and financial crunch and for what he called “a strongly empowered systemic risk regulator.”

For Frank, perhaps more than any single individual in private or public life, is responsible for both the housing market mess and subsequent bank disaster. And no, this isn’t partisan hyperbole or historical exaggeration.

But first, a little trip down memory lane.It was Fannie Mae and Freddie Mac, the two so-called Government Sponsored Enterprises (GSEs), that lay behind the crisis. After regulatory changes made to the Community Reinvestment Act by President Clinton in 1995, Fannie and Freddie went into hyper-drive, channeling literally trillions of dollars into the housing markets, using leverage and implicit taxpayers’ guarantees.

In November 2000, President Clinton’s Housing and Urban Development Department would trumpet “new regulations to provide $2.4 trillion in mortgages for affordable housing for 28.1 million families.” The vehicles for this were Fannie and Freddie. It was the largest expansion in housing aid ever.

Still, from the early 1990s on, many people both inside and outside Washington were alarmed by what they saw at Fannie and Freddie.

Not Barney Frank: Starting in the early 1990s, he (and other Democrats) stood athwart efforts by regulators, Congress and the White House to get the runaway housing market under control.

He opposed reform as early as 1992. And, in response to another attempt bring Fannie-Freddie to heel in 2000, Frank responded it wasn’t needed because there was “no federal liability there whatsoever.”

In 2002, Frank nixed reforms again. See a pattern here?

Even after federal regulators discovered in 2003 that Fannie and Freddie executives had overstated earnings by as much as $10.6 billion in order to boost bonuses, Frank didn’t miss a beat.

President Bush pushed for what the New York Times then called “the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago.”

If it had passed, the housing crisis likely would have never boiled over, at least not the extent it did, taking the economy with it. Instead, led by Frank, Democrats stood as a bloc against any changes.

“Fannie Mae and Freddie Mac are not facing any kind of financial crisis,” Frank, then the ranking Democrat on the Financial Services Committee, said. “The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing.”

It’s hard to say why Frank did all this. It could be his close ties to the Neighborhood Assistance Corp., a powerful housing activist group based in Boston, which controls billions in loans. Or that he received some $40,100 in campaign donations from Fannie and Freddie from 1989 to 2008. Or that he has been romantically linked to a one-time executive at Fannie during the 1990s.

Whatever the case, his conflicts are obvious and outrageous, and his refusal to countenance reforms of Fannie and Freddie contributed mightily to today’s meltdown. If you’re looking for a culprit in the meltdown to prosecute, no one fits the bill better than Frank.